Halifax Calculates Most Affordable Cities for Property Purchase

As UK house prices have surged during the past few months, spurred on by the stamp duty holiday and pent-up demand following lockdown, some potential landlords might find it a struggle to find the right area or city for investment.

However, a recent report has classified the UK's regions in terms of affordability making it a little easier to select the right place to make a new investment.

As you might expect, the top 20 most affordable cities are all in the north of England, Northern Ireland and Scotland with Hereford featuring as the most southerly city on the list. Meanwhile, six of the top ten most affordable cities for property are in Scotland, highlighting the recent increase in prices across England.

Property Investment Opportunities

For those considering buying a property, either as a home or as an investment option to rent out, there are a number of cities where this makes financial sense. Of course, while the most affordable are all in the north of the UK, it can still prove a positive decision to make Buy-to-Let (BTL) purchase miles away from your home.

With an average property price of £155,917, Londonderry in Northern Ireland is the most affordable city in the UK, according to Halifax. The mortgage lender also calculates the average annual salary to buy a property here is £33,138, giving it a price to earnings (PE) ratio of 4.7. Carlisle in the north of England, Bradford in Yorkshire and Humberside and then Scottish cities of Stirling and Aberdeen make up the top five most affordable cities for property purchase.

Top 10 Most Affordable UK Cities

Source: Halifax

Looking at Hereford, which is the 20th most affordable city for property prices and also the most southerly in the list, the average property price there is £316,929, with a PE ratio of 6.6 and average earnings of £48,048.

Investment Options Remain

For many property investors and tenants, these more affordable cities could become a great place for them to make a first or next purchase, or in the case of tenants, find a new home where their money can go further. Indeed, with one of the results of the pandemic being that many employers will be more open to remote-working options, a move away from the more expensive cities while still working for the same company is a real possibility for many.

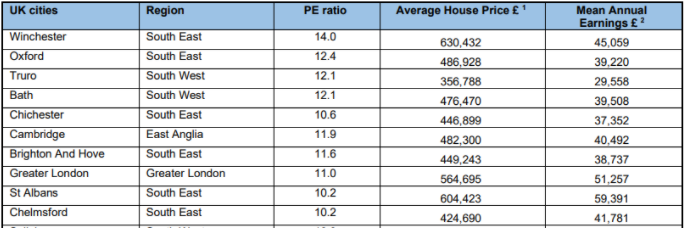

In addition to the most affordable cities, Halifax also calculates the least affordable UK cities to buy a home, with Winchester topping the list. The reason for this is because the average house price of £630,432, is some 14 times the average earnings in the region which stand at £45,059. That huge differential between earnings and prices puts buying a home out of reach for many of the local residents. And while some property investors may still be well-placed to make a purchase in the city, the rent levels likely dissuade many tenants from making it their home.

Top 10 Least Affordable Cities

Source: Halifax

“Rising house prices have generally continued to outstrip wage growth, which reduces overall affordability,” said Halifax managing director, Russell Galley.

While it’s clear that in terms of property prices the north/south divide remains in place across the UK, there are still a number of options for property investors to make their next BTL purchase. Meanwhile, tenants could also begin to look elsewhere to make their money go further and even begin to save for their own deposit for future home-buying ambitions.